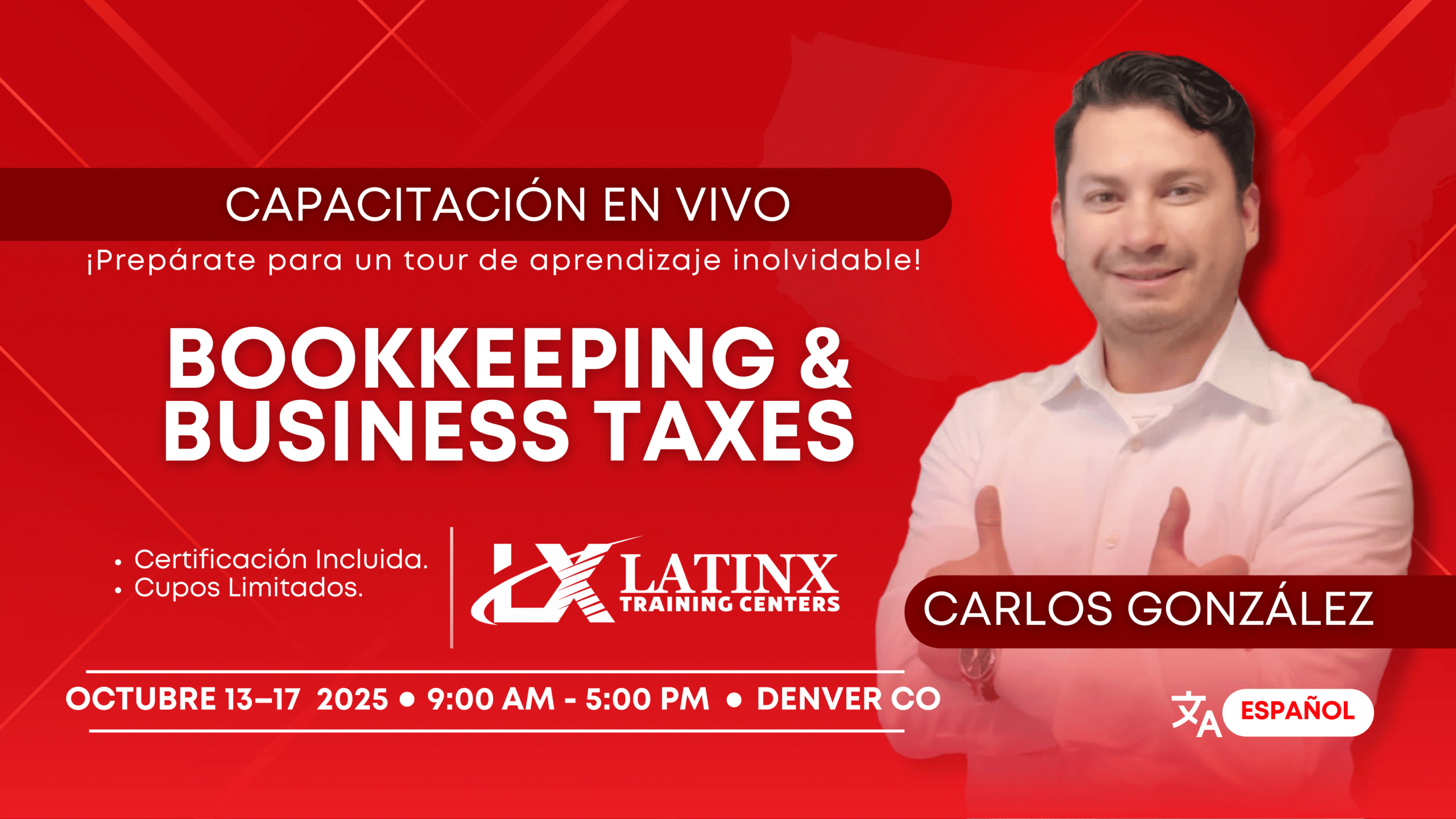

Bookkeeping & Business Taxes – Carlos Gonzalez (Denver CO)

About Course

Instructor: Carlos Gonzalez

Dates: October 13 al 17, 2025

Address: Denver, CO

Time: 9:00 am to 5:00 pm CDT

50 hours of in-person training in bookkeeping for small businesses.

In this intensive course held on-site in Denver, you will learn the fundamentals of accounting to become an efficient bookkeeper. This immersive classroom experience is designed to give you the tools and confidence to handle real-world bookkeeping tasks.

Requirements to take the course:

If you agree with these requirements, please purchase the corresponding course. If you do not meet the requirements, you will not be able to be included in the bookkeeping course.

-

Have a high school diploma or at least 3 years of experience preparing taxes.

-

Commit to attending all scheduled sessions in person.

-

Arrive on time and be prepared to focus fully in a distraction-free environment.

Additional benefits

- Logistical and Technological Consulting for 12 months: Our team of accountants and professionals will be available to answer any questions related to the entire bookkeeping course and the modules included.

- Online Professional Profile: All your professional information will be included in an Exclusive Group of Professionals where Hispanic small business owners can access your services. This exclusive group will be online under the LatinXtraining.com website. The participant must agree to be included in this group of Bookkeeping professionals.

Additional modules

- QuickBooks or Xero Certifications: You choose the certification you want for the accounting system you will use to do the company’s bookkeeping. During this course, you will receive the process to obtain the certification directly from Intuit for QuickBooks and Xero.

- Choosing Business Entities: In this module we will explain in detail the different business entities and their tax consequences. When a client contacts you for a business idea, you will be able to explain the options and consequences of each business entity and which will be the most appropriate to meet the objectives required by the client and benefit their legal protection.

- Preparing Corporate Taxes: After having done the business accounting, you now need to prepare the corporate forms depending on the type of business entity you have. In this module you will learn the forms you should use and, above all, how to implement the accounting data to prepare the corporate form.

- Creating Business Entities: In this module you will learn the step-by-step process of the complete package for creating an entity, to ensure that the client has everything required to run their company under the regulations of both federal, state and local governments.

Course Content

Curriculum

-

Accounting concepts, financial statemets, analyzing & classifying transactions

-

Recording transactions, adjusting and closing procedures

-

Quickbooks introduction and certification process, summarizing and reporting via the service business work sheet, summarizing and report via the retailer business of work sheet & costing merchandise inventory

-

Quickbooks hands on practice, alternative inventory valuation methods, repetitive transactions & capital and equity

-

Continuing with quickbooks hands on practice, receivables and payables, cash and its control & payroll. general overview

-

Quickbooks final session for certification, property building and equipment: depreciation & property building and equipment: disposal and taxation

-

Session 1 Exam

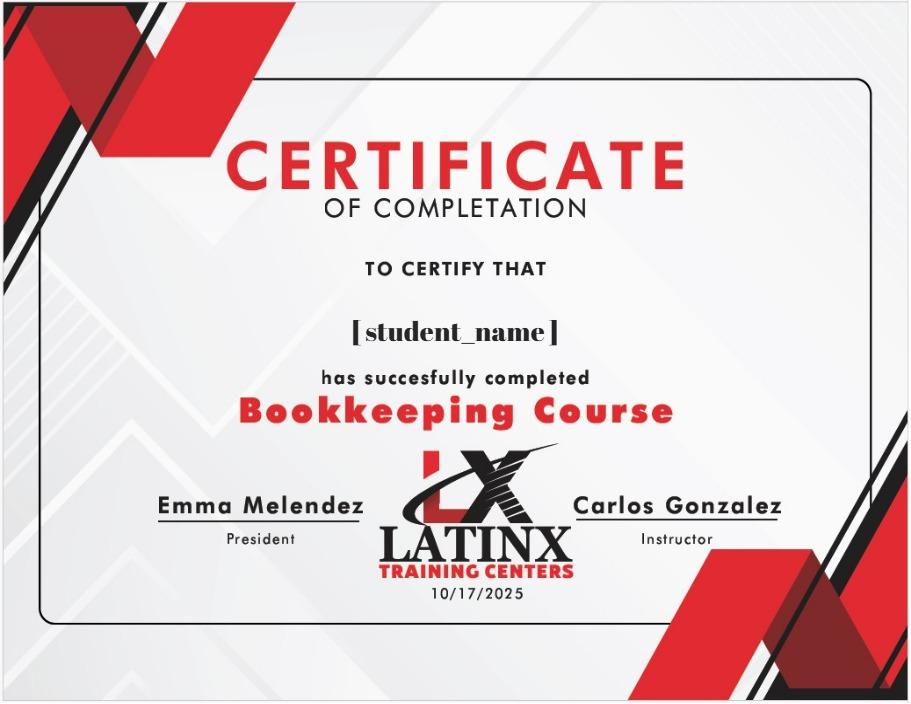

Earn a certificate

Add this certificate to your resume to demonstrate your skills & increase your chances of getting noticed.

Student Ratings & Reviews